As we all know that MRF is one of the most expensive stock when it comes to the absolute stock value. Currently it is trading at 128560 at the time when we are writing this post.

Why is it important to talk about MRF Ltd stock price well that is because the auto sector in India is at its all-time run, as a consequence of which all the auto ancillaries companies stock price are also giving some great returns, it is not very long when all the tyre manufacturers were making new all-time highs every week. But now from the last few weeks due to some margin constrain news tyre manufacturers have seen some pressure in the stock pricing. Most of the tyre manufacturing companies have already come up with Q4 numbers including MRF and we are witnessing some volatility in stock price.

If somebody is interested in investing in MRF or has already, this post is important for them because we will going to evaluate MRF Stock price under the following key analytics metrics.

- Correction from its 52-week high and low.

- Stock price to earnings ratio in comparison to the sector.

- Stock price in comparison to its 90 and 20 days moving average.

- EPS Growth year-on-year trend.

- Latest sentiment around the tyre stocks.

- Company shareholding pattern.

- Support level on the charts and RSI on a monthly timeframe.

Correction from its 52-week high and low

From its 52-week low stock is up by around 31% and from its 52-week high stock is down by around 15%. That shows it is still in its upward moving trajectory because upside is higher than the downside. When will the stock going to cover up the 15% ground that it already has lost from high?

Stock price to earnings ratio in comparison to the sector

MRF Stock PE ratio is around 24 where as the sector PE ratio is around 54, that clearly suggest that the stock price of MRF is not as expensive as the other stocks in the same sector are. PE ratio also suggest that the stock value is under priced, is it because the stock value is expensive at least at the face of it for some of the investors and if somebody carries a small amount, he can’t even own a single quantity of MRF Stock.

Should the company seriously consider about splitting its stock to attract more investors because what it looks like is in the current scenario of stock value higher than one lakh rupee seems to be not attracting and helping the valuation of the company in comparison to the sector valuation.

Stock price in comparison to its 90 and 20 days moving average

Red line suggest the 90 DMA and blue line is the actual stock price, as we can see that the current price is bellow its 90 DMA. Also its 20 DMA is 131800 and stock value is just there suggest some pressure w.r.t 90DMA and sideways movement in last 3 weeks.

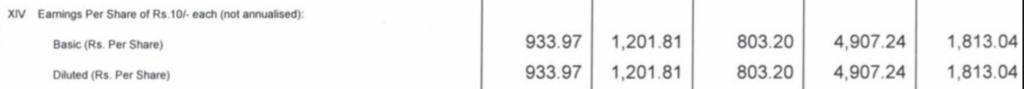

EPS Growth year-on-year trend

Above screenshot is from its Q4 earning note, basic EPS has moved to 4907 from 1813 on YOY basis and on QoQ basis its now 933 from 803.

Latest sentiment around the tyre stocks

Check out some of the news trending around MRF that will suggest the sentiments around stocks, as per us its more around its upcoming low dividend announcement and the margin pressure on the sector.

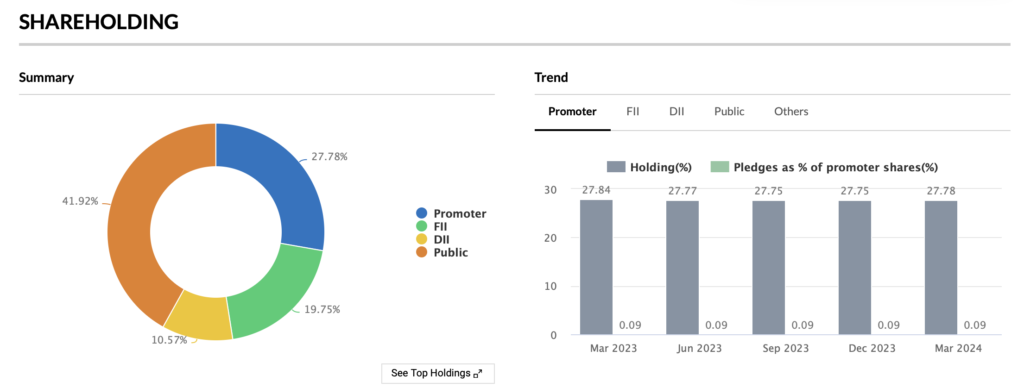

Share Holding patterns

(Source:Moneycontrol.com)

Slight upside in Share holding by promoters on QoQ basis and slight downside on YoY basis but more or less its on the constant side. Public is the biggest share holder of this company suggest that volatality could be good enough during some big event but needless to say stock piece always act as a cushion for it.

Support level on the charts and RSI on a monthly timeframe.

Stock seems to be resting on its immediate support level of 127000 where it has taken support in last three weeks. Post result announcement also when stock showed some downside it was 127000 level only near which it took support, hence these are important levels to watch. On the upside considering stock is undervalued in comparison to sector PE valuation head space is big enough for investors to feel good about, RSI on monthly timeframe is near 65 showing strength on the chart.

Disclaimer:- Observation on this stock/article is author personal opinion and does not include any buy or sell recommendation.

+ There are no comments

Add yours