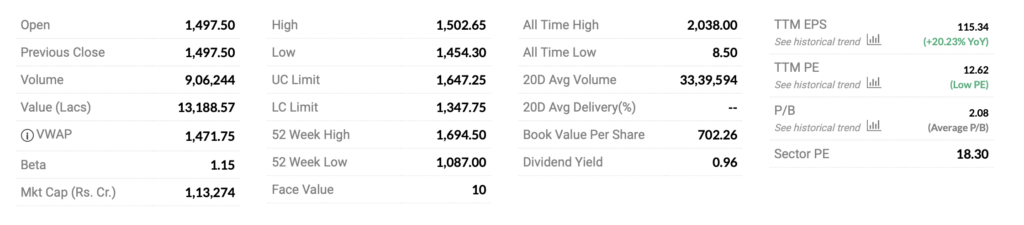

Why IndusInd bank is not performing even though the EPS is 115 which is also growing by 20% year-on-year & the PE, which is price to earnings is over 12. The industry PE is around 18 all the popular banks like HDFC bank, ICICI bank, Kotak Mahindra bank are hovering around a PE of nearly 18. So why is it that the EPS of IndusInd bank is much better than the names of the bank that we have just said, why is it IndusInd bank has not been able to attract investors ?

if somebody will watch the results of IndusInd bank closely on the quarterly basis, he will find out that IndusInd bank is one of the most consistent bank with respect to rising revenues. Consistent exit quality rising loan books, stable Kasa growth yet we don’t see that any big fund manager or any big FII seems to be respecting these good fundamentals

Book value of the stock is also 702 when it is trading at price to book ratio of 2.8, which is again quite reasonable market cap is more than one lakh crores. Stcok has made its 52-week high of around 1700, but we saw some sliding down from that price. Now this confuse the investor who invest in the stock with focusing some good fundamentals because we have seen some of the banks with very poor EPS doing better than IndusInd bank when it comes to the returns to its stakeholders and that’s the reason why we have seen some shareholders losing hope & exiting.

It is a matter of debate that why sometime only price and volume momentum seems to be a more attracting proposition than the good fundamentals because we have seen people putting more money at companies with very poor earning, but having good price and volume momentum, people seems to be putting their heavy amount of money on some risky assets then some of the safe hands and why is it that the big fund manager seems to be ignoring some good fundamentals available in the market like IndusInd Bank ?

Data Source :- moneycontrol.com

+ There are no comments

Add yours