We have often seen example of companies where inspite of heaving high EPS, PE ratio seems to be struggling, Canara Bank is one of the same pedigree. But why is it ? We will try to analyse and answer the same question.

About Canara Bank

Canara Bank is one of the largest public sector banks in India, with a rich history spanning over a century. Established in 1906, Canara Bank has grown to become a trusted financial institution, offering a wide range of banking and financial services to individuals, businesses, and corporates.

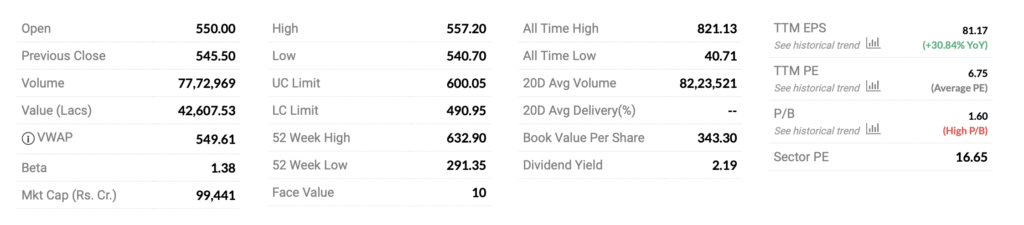

Stock is currently at 548 at the time of writing this article, Bank is about to hit 1 lack Cr Market Cap. Canara Bank stock made an all time high of 821 and low of 40.71. All these data points are OK but what surprises us is the EPS and EPS growth of Canara Bank and why with such good EPS, PE ratio is just 6.75. Is this because it’s a Government sector Bank, we know that PE ratio of SBI is also around 11 but SBI was also at very Poor PE ratio which got corrected in 2023 & 2014 first half.

Government sector Bank and Government sector companies are now improving their PE Ratio and Canara Bank could be another one in the list.

Through the stock price last year was near 300 during same time but the EPS since then have also grown by 30% and yet is PE ratio showing poor valuation if earning need to be a valuation criteria.

Though there are lot of criterias to see if company is over priced or underpriced, we are currently focusing on EPS and further PE as an idea to determine the same.

Services Offered

Canara Bank provides a comprehensive suite of banking services to cater to the diverse needs of its customers. From basic savings and current accounts to loans, credit cards, and insurance products, Canara Bank offers a wide array of financial solutions.

For individuals, Canara Bank offers various types of accounts, including savings accounts, current accounts, and fixed deposit accounts. The bank also provides loans for different purposes, such as home loans, car loans, education loans, and personal loans. Additionally, customers can avail themselves of credit cards and insurance products offered by Canara Bank.

For businesses and corporates, Canara Bank offers specialized services like working capital finance, trade finance, cash management, and treasury services. The bank also provides customized solutions to meet the specific needs of different industries, including agriculture, SMEs, and large corporates

Sector to which Canara Bank focus for lending have bright future and we can see Bank doing great in the near future and hence investors can see a great value in the same.

Disclaimer :- All the facts & the figure presented in the article are taken from internet and all the opinion presented in the article are authors personal opinion and this is not at all an investment suggestion. Before any buying and selling in the stock, please check with your investment advisor.

+ There are no comments

Add yours