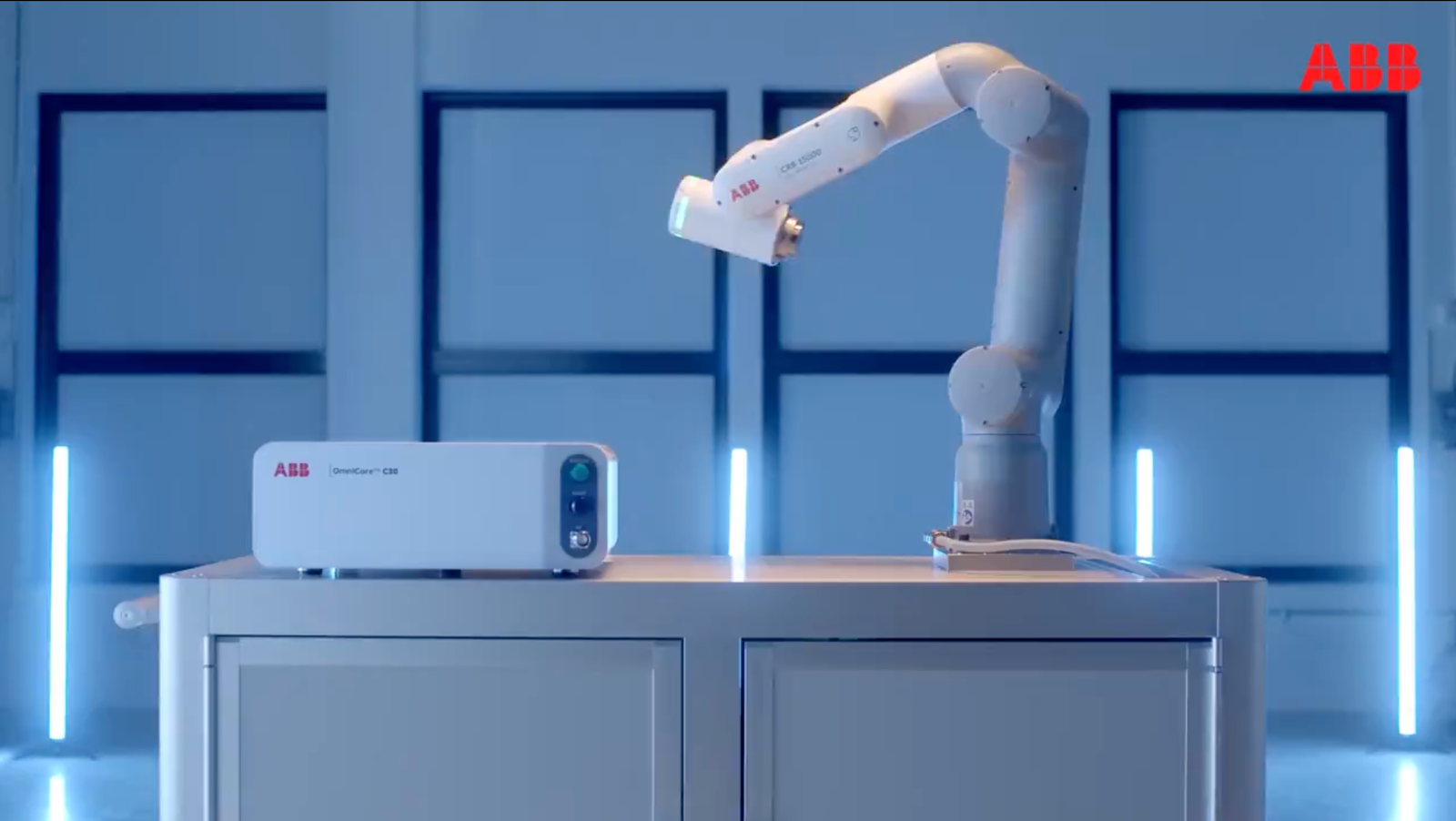

Company Products: ABB India is hitting all time high, its a producer manufacturing company that makes electrical parts like actuators, air insulated switchgear, arc fault protection and many more devices in same category.

Why stock price is rising: In the last few years after robust capex done by government side, electrical manufacturer are on rise. Companies have seen rise in there margin and revenue both, as a result companies have declared not only rise in there quarterly numbers but there forecast for upcoming quarters is also very robust.

Stock Price and key technical indicator: ABB India current stock price is 9020 as on 15th June 2023 closing and stock is at all time high.

What does some of the key technical indicators suggest ?

Moving Average: We will be seeing 20 DMA and 90 DMA on daily time frame. It was November 2023 when 20 DMA crossed 90 DMA and since then it’s trending above 90 DMA. 20 DMA is at 6584 and 90 DMA is at 5702 and ABB stock is at such a high run that its current market price is far above its 20 DMA also. Moving average clearly suggest that till 20 DMA will remain over 90 DMA there is a great possibility that this rally will continue.

RSI (Relative Strength Index): Since February 2024 its RSI is above 50 and currently it’s at 72 on a daily time frame. On 4th June also when election results were getting announced and all stock prices were shaking, ABB never gone bellow 50 RSI, in fact after that we saw a new all time high.

Companies in same sector: When it comes to market cap Siemens, ABB, Havells and Polycab are the big players, all of these private sector companies are in their all time high range. One interesting fact is ABB management is extremely bullish in there corporate commentary for future outlook and due to that ABB price to earning ratio is (131) more than the sector PE (110). PE figures can be seen at https://www.nseindia.com website.

Key Strengths of ABB: Stock is above its short and long term moving average, company with hight EPS growth, ROCE improving in last two years, ROE improving in last two years, growth in net profit and margin, company with zero debt, book value per share improved in last two years, company with zero share pledged by promoter, FII increasing there share holding,

Key Weakness of ABB: Mutual funds decreased there holding last quarter.

Key Positive points for future outlook: Brokers upgraded there price target for ABB, stock with positive outlook for upcoming results, highest recovery from 52 weeks low.

Threat for Stock: Stock with high Price to earning ratio.

Author personal opinion: All these data points are fine and different people will read these figures differently, my personal opinion about ABB is to watch from outside because its PE is above sector, i will wait for ABB to imrove its earning so its PE ratio comes down or stock show some correction. Any stock above 100 PE goes out from many funds managers list and I think that’s the reason why MF have decreased their holdings.

Disclaimer :- All the facts & the figure presented in the article are taken from internet and all the opinion presented in the article are authors personal opinion and this is not at all an investment suggestion. Before any buying and selling in the stock, please check with your investment advisor.

+ There are no comments

Add yours