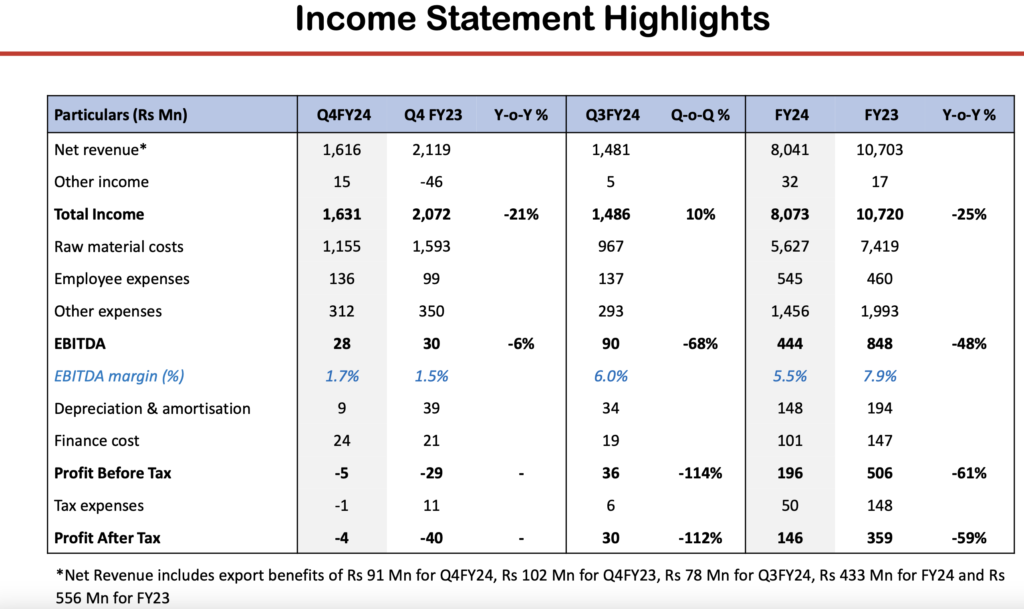

Sales Volumes at 2,302 MT in Q4FY24 and 10,949 MT in FY24, were impacted due to subdued demand from our key market, the USA. Amidst this weak sentiment, the preliminary Countervailing Duties (CVD) imposed by the USA on Indian frozen shrimp at 4.36%, acted as an additional dampener.

The European Union (EU) market continued its growth momentum with ~31% growth in FY24. We are currently catering only to the RTC demand in the EU as we still await regulatory approval to sell RTE in the EU.

Global shrimp prices which have been tapering off in recent months continue to remain at subdued levels. Consequently, our Average Realization remained flat QoQ and down by 6% YoY at Rs 663* per Kg in Q4FY24.

Gross Debt reduced by Rs 599 Mn from Rs 1,668 Mn as of 31-Mar-22 to Rs 1,069 Mn as of 31-Mar-24. Total Debt To Equity remains at a comfortable level of 0.22 times.

Healthy growth in Net Cashflow from Operations from Rs 355 Mn in FY22 to 1,116 Mn in FY24.

Disclaimer :- This information is taken from company filing to exchange.

+ There are no comments

Add yours