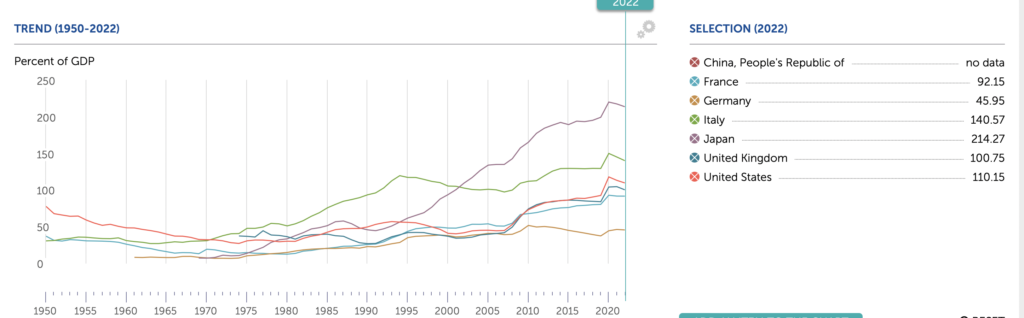

Source:https://www.imf.org/external/datamapper/CG_DEBT_GDP@GDD/CHN/FRA/DEU/ITA/JPN/GBR/US

As per the IMF data published in 2022, Debt of big economy is rising and if we compare it with their GDP size figures are concerning.

Naming few of the Big Economy USA has 110%, UK has 100%, Japan 214%, Italy 140%, Germany 45% & France 92% Debt to GDP ratio.

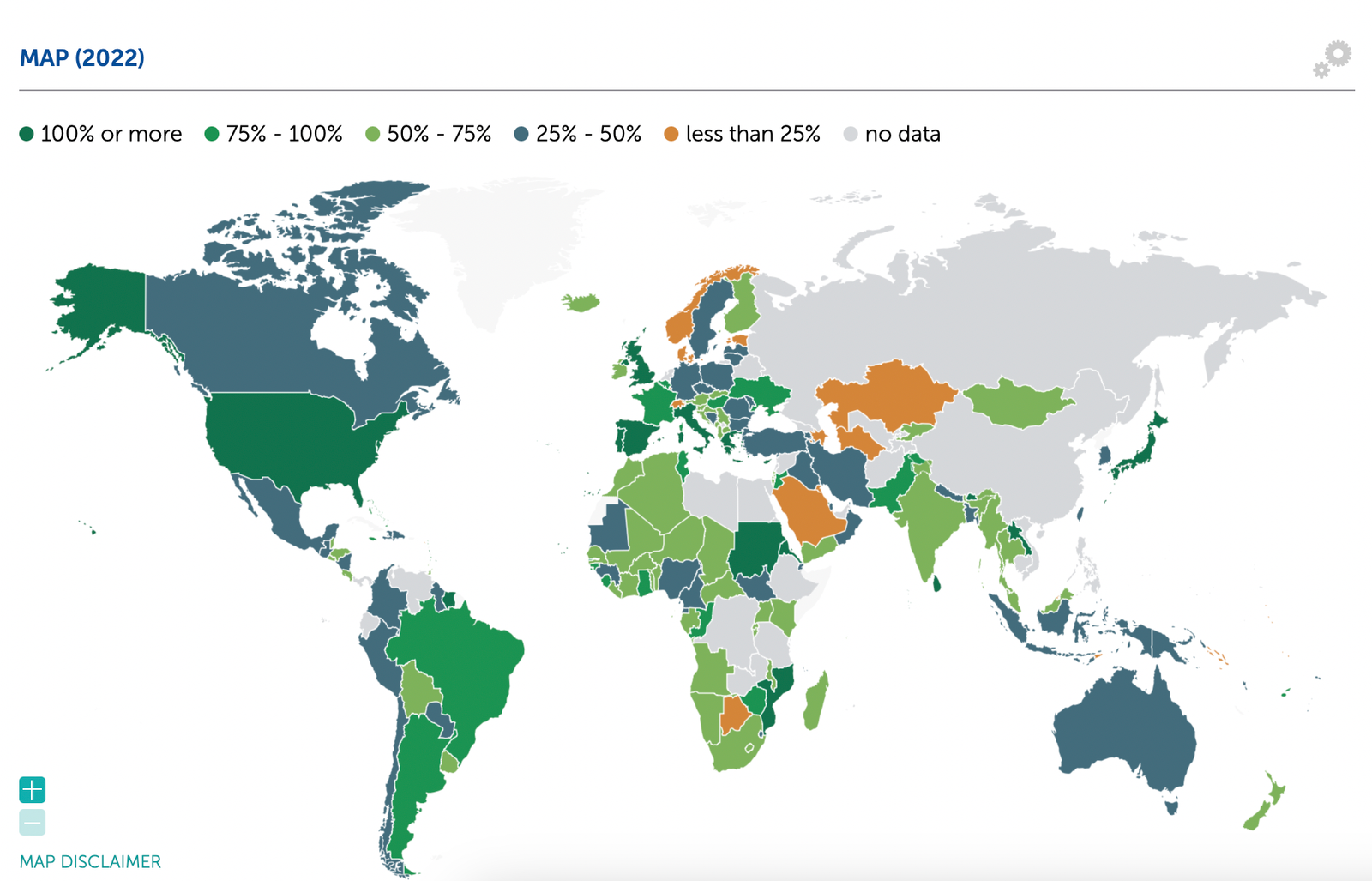

For China on the other hand, no data is presented. India with is also the 5th largest economy has around 50% Debt to GDP Ratio.

Countries that have comparatively controlled Debt to GDP ratio are Germany and India where it is 45% and 50% respectively.

It would also be good to know the true defination of GDP and Debt to GDP.

What is GDP?

Gross Domestic Product (GDP) serves as a crucial indicator of a nation’s economic performance. It quantifies the total monetary value of all finished goods and services produced within a country’s borders over a specified period, typically measured annually or quarterly. GDP encompasses various components that collectively provide a comprehensive picture of economic activity. These components include consumption, investment, government spending, and net exports (exports minus imports).

Consumption refers to the total value of all goods and services consumed by households. It includes expenditures on durable goods like cars and appliances, non-durable goods such as food and clothing, and services encompassing healthcare, education, and entertainment. Investment, on the other hand, pertains to business expenditures on capital goods, residential construction, and changes in inventories. Government spending includes expenditures on goods and services that government consumes for providing public services, as well as investments in infrastructure projects.

Net exports are calculated by subtracting the value of a country’s imports from its exports. A positive net export indicates a trade surplus, while a negative net export signifies a trade deficit. Together, these components provide a holistic view of the economic activities within a country.

There are three primary methods to calculate GDP: the production approach, the income approach, and the expenditure approach. The production approach sums the value added at each stage of production. The income approach aggregates the total national income, including wages, rents, interest, and profits. The expenditure approach, the most commonly used, tallies the total spending on the nation’s final goods and services.

GDP is a significant economic indicator as it reflects the economic health and standard of living within a country. Policymakers and economists rely on GDP data to formulate fiscal and monetary policies, gauge economic performance, and make international comparisons. High GDP growth often signifies a robust economy with a high standard of living, while stagnant or negative GDP growth could indicate economic challenges.

Understanding the Debt-to-GDP Ratio

The Debt-to-GDP ratio is a crucial economic metric that compares a country’s total public debt to its Gross Domestic Product (GDP). This ratio is calculated by dividing the nation’s government debt by its GDP, then multiplying the result by 100 to express it as a percentage. For example, if a country has a public debt of $1 trillion and a GDP of $2 trillion, its Debt-to-GDP ratio would be 50%.

This ratio serves as an important indicator of a country’s economic health. A high Debt-to-GDP ratio suggests that a country may have difficulty in repaying its debts without incurring additional debt. This can lead to decreased investor confidence as creditors might perceive the country as a higher risk, potentially resulting in higher interest rates on future borrowing. High public debt can also restrict a government’s ability to finance other public services, such as education and healthcare, as a larger portion of the budget is allocated to debt servicing.

Conversely, a low Debt-to-GDP ratio is generally seen as a sign of economic stability, indicating that the country produces enough economic output to manage its debt effectively. However, it is important to note that what constitutes a ‘healthy’ Debt-to-GDP ratio can vary significantly depending on the context. For instance, developed countries often sustain higher ratios than developing nations due to better access to financial markets and stronger economic fundamentals.

Economists and policymakers use the Debt-to-GDP ratio to assess fiscal sustainability and the ability of a country to repay its debts. This assessment guides decisions on fiscal policies, including taxation and government spending. Historical trends and comparisons with other countries provide valuable context. For example, Japan has a Debt-to-GDP ratio exceeding 200%, yet it remains one of the world’s largest economies, whereas a much lower ratio might signal distress in a smaller, less developed country.

Understanding the Debt-to-GDP ratio is essential for making informed judgments about a country’s economic stability and its capacity to meet financial obligations. This metric, therefore, plays a pivotal role in shaping both domestic and international economic policies.

Disclaimer :- All the facts & the figure presented in the article are taken from internet.

+ There are no comments

Add yours