When investors talks about some of the stocks that have disappointed them the most Delta Corp is one of the company that top the chart, it is down by over 50% from its 52 weeks high. It’s not the first time when it made a high and came down so drastically that all the people who were trying to hold it for medium to long-term have either exited or have lost their money.

Delta Corp belong to the leisure segment that offer casino & online poker game facility to its consumers. Do this sector is under explored in India and often Indian tourist go abroad and play poker in abroad. But in India poker and online gaming and online poker segment has yet not been evolved due to some hesitant in the culture and due to governments have not shown interest in promoting it either.

Now with the tourist industry is getting hyped in India and we see a lot of hotels and lot of tourist related sector making new highs. Why is it that the Delta Corp is still at the back seat, is it to do with the way they run their operations or the sector itself in India due to political or cultural region will never going to grow ?

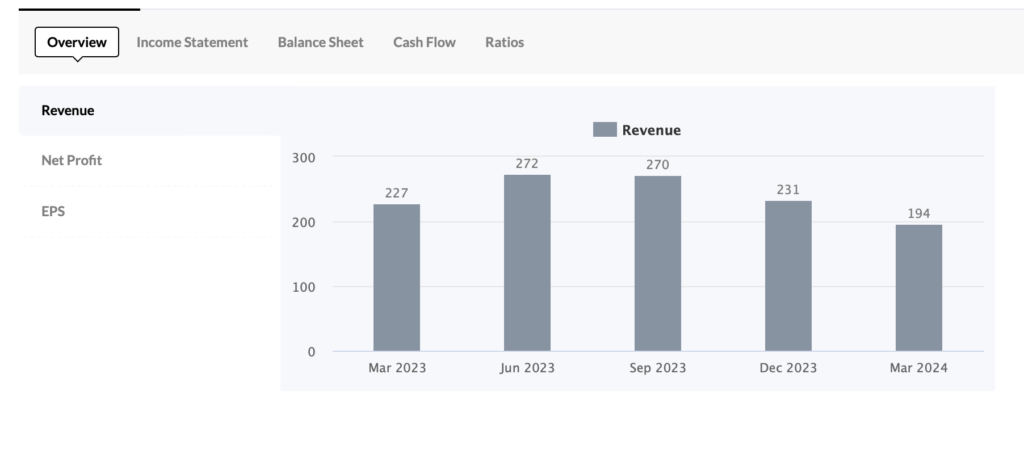

Let’s talk about some data points, Delta Corp stock has an EPS of around 8 it’s PE ratio is around 14 and settle PE ratio is around 18.

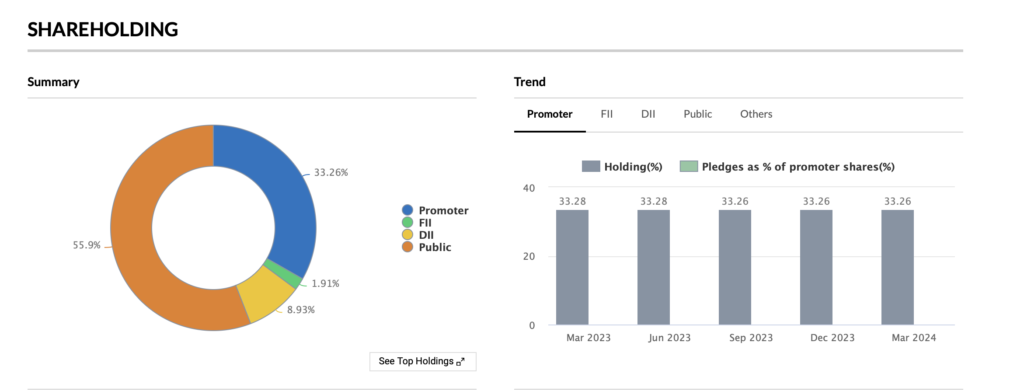

It would be interesting to see who actually owns Delta Corp, 33.26% is owned by promoter FIIs hold only 1.91% of it, DII hold around 8.93% and public hold 55.9% stake in Delta Corp. So we can see that the holding itself suggest that the big players like FIIs and DII’s doesn’t hold his company that much.

Now one can argue that it could be cultural issues when it comes to acceptance of casino as an activity in India, but how will you defend the de-growing revenue of the company itself one can go against the fact that there is no cultural hesitant in India and the company will grow but when you look at the company’s number you have no other option but to stay away we have seen a decline in the revenue number from its year ago in march quarter and previous quarter of December.

look at this very interesting chart of Delta corp and how not once but twice when the company stock has touched beyond 300 level, It has come back to less than 100 value. This time again it looks like it will going to go less than 100. There is a trend line seems to be at the level of around 50 to 60 to 80 that give support to the stock and then from there again it makes a really as far as 300 level.

What should an investor do, see an intelligent investor would always wait for the turnaround in company result, an intelligent investor will never try to catch the bottom because we don’t know if this time the trend line will going to support Delta corp and intelligent investor will always wait for the profit numbers to continue for minimum couple of quarters an intelligent investor will always see if the company is growing with respect to net profit and revenue. It is only then an investor will jump into it.

Disclaimer :- All the facts & the figure presented in the article are taken from internet and all the opinion presented in the article are authors personal opinion and this is not at all an investment suggestion. Before any buying and selling in the stock, please check with your investment advisor.

+ There are no comments

Add yours