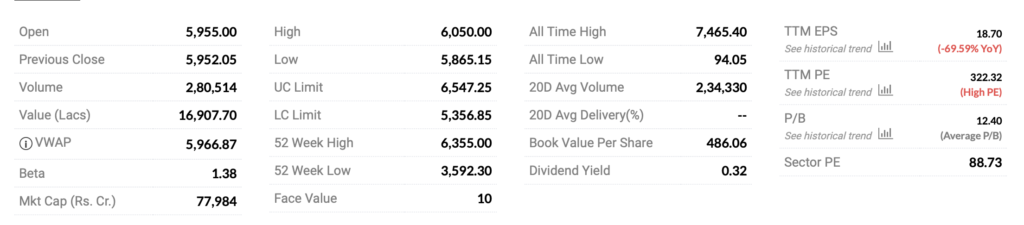

Info Edge India stock price above 6000 is almost near its all-time high but when we look at its year-on-year EPS growth, we don’t see very promising trends, the current price to earnings ratio of info edge, which is also popularly known as Naukri.com is 322. The sector price to earnings ratio is 88. Now the biggest question is, Is info edge at price which is above 6000 at an PE Ratio of 322 where the sector PE is 88, overvalued ?

We know that stock prices are generally the price of the stock considering its future potential also. So whenever the investor see some positive future growth possibility of a stock we generally see that stock or a company become expensive than its peers. It looks like the naukri.com or info edge is going through the same phase where the investor seems to be giving it more valuation insight of India growth story where more and more people will be hired or would look for employment where more and more company would need staff to hire and naukri.com seems to be an old and a big player in the market.

Market cap of info edge is over 77,000 Cr. Stock trade at 1.38 beta and has made 52-week high of 6355 and 65 weeks. low of 3592. Company stock price face value is 10 & Book value per share is around 486 & price to book is 12.4.

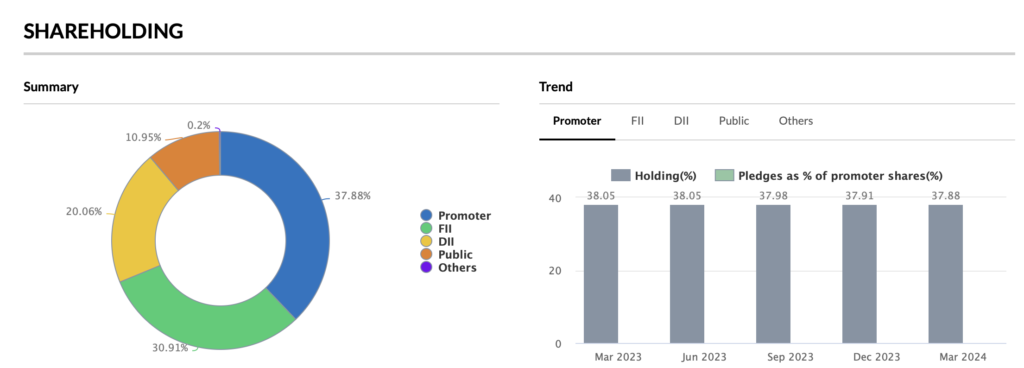

In the upcoming March quarterly number we also see some decline in the shareholding pattern where the promoter shareholding has decreased from 38.05% to 37.88% promoter is the biggest shareholder in the company followed by FIIs, 30.91%, then DIS 20.06% followed by public 10.95%.

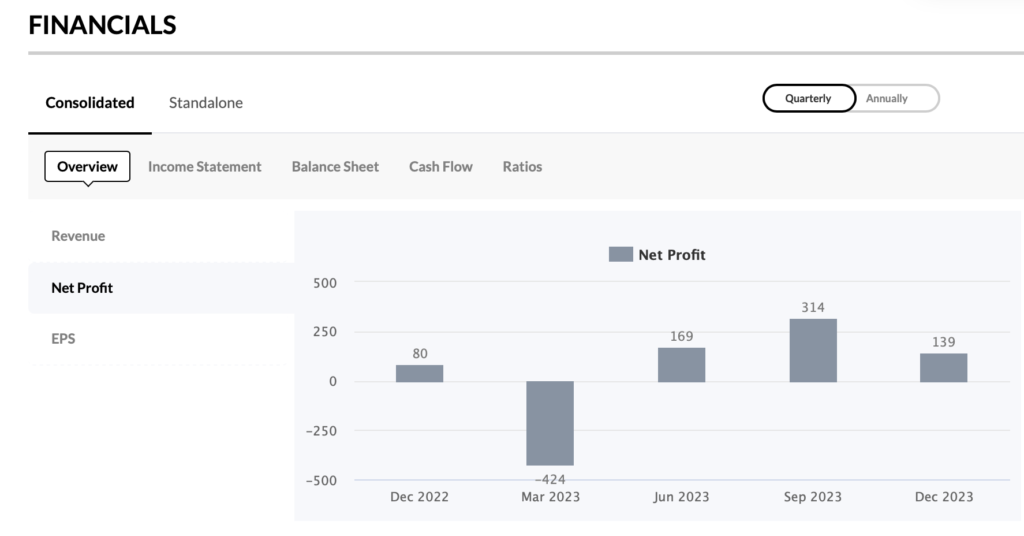

When we look at the quarterly trend of net profit earned by the company, there seems to be some non-consistent performance, in the quarter March 2023, the net profit was in negative, since then we have seen some improvement but from September quarter to December 2023 there was a decline in the net profit. Hence we can say that the net profit is not very consistent, sometime it is negative & sometimes it is positive yet stock price seems to be unaffected.

Caution of Investors

We can say whatever that the future prospect of the company looks very promising looking at India growth story but we cannot forget that company is at 300 and plus EPS seems to be overvalued. Now there could be some super great analysis that some of the investor must have done while investing in the company and stock price seems to be supporting their analysis but when you invest in a company with the EPS of 300 you should have your 100% facts right needless to say that the stock market is a place where one get surprised because not everybody have all the knowledge to be able to evaluate a company. We have seen cases where companies with very high EPS have very low P/E ratio & companies with very low EPS with very high P/E ratio light naukri.com.

Disclaimer :- All the facts & the figure presented in the article are taken from internet and all the opinion presented in the article are authors personal opinion and this is not at all an investment suggestion. Before any buying and selling in the stock, please check with your investment advisor.

+ There are no comments

Add yours