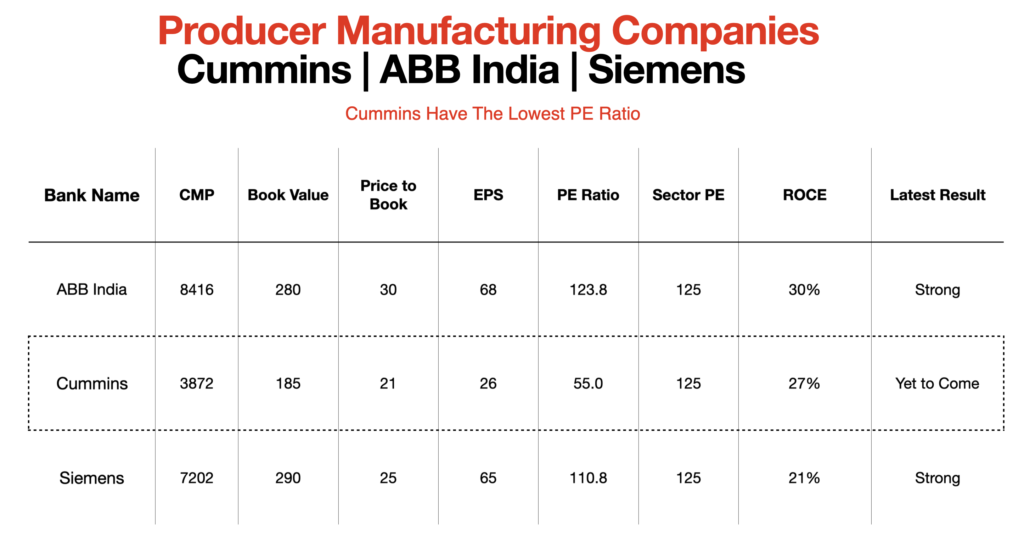

This year till now some of the Producer Manufacturing companies have given Amazing return on investment to its investors. Here we are comparing three major companies, ABB India, Cummins, Siemens India.

We were going to evaluate these companies bases their book value, price to book, EPS, PE ratio and their ROC.

- Book value of any company is the value of all the assets of the company and dividing that value with the number of outstanding shares. Hence what we get is the actual valuation of the asset of the company in the form of share. If you look at this parameter Siemens has the best book value of 290 but when we look at the price to book, we will have a different picture that comes in front of us.

- Price to book suggest that both Cummins and Siemens has reasonable book value than ABB India which is around 21 and 25 respectively.

- Earning per share is the earning of the company divided by the number of outstanding shares. So we get a figure that how much company earn against each of its share that is there, so if you see this parameter, we see that ABB India has the highest EPS of 68.

- PE ratio is the share price value divided by the EPS so what we get is the P/E ratio PE ratio tells us that how expensive is the company against its earning and against its sector. Average PE ratio in producer manufacturing sector is around 125.

- Cummins has the lowest PE ratio here which is 55, suggest that we might see further upside in this stock.

- Return on capital employed is the parameter that tells us that how much company earns against the capital employed by the company and in this parameter both ABB India and Cummins have ROCE of over 25%.

When we overall look at this parameter we see Cummins India currently outstand and come up as comparatively reasonably valued.

Disclaimer :- All the facts & the figure presented in the article are taken from internet and all the opinion presented in the article are authors personal opinion and this is not at all an investment suggestion. Before any buying and selling in the stock, please check with your investment advisor.

+ There are no comments

Add yours