Shree Cement Investors are disappointed by Shree Cement performance since its has given negative in 2024.

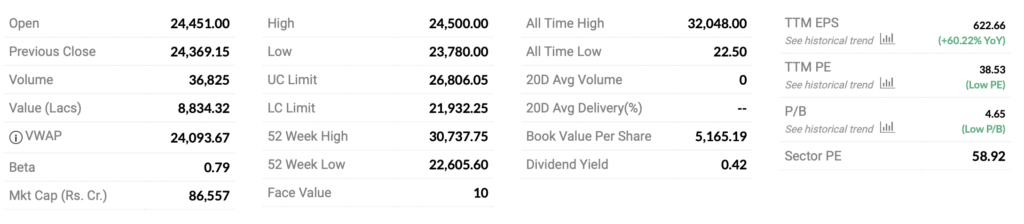

If we look at some of its financial data. As on today money control web site is showing following data.

PE : Against Sector PE stock is still undervalued.

EPS : EPS is extremely good with a moderate PE valuation looks reasonable.

52 W High : Against 52 week high stock has already been corrected by 7000 points.

Now next month Shree Cement will be coming up with its Q4 update, Dalmia Bharat has not posted a good result in Q4, will the entire cement sector follow the same pattern we have to wait and watch but these are the lows one need to start keeping watch, may be a reversal can be seen if earning surety will be seen in future.

Shree Cement also remind of lot of Risk management tools that investors should take care.

Investing in the stock market can be a lucrative venture, but it also comes with its fair share of risks. To navigate these risks, it is crucial for stock market investors to have a solid risk management strategy in place. In this blog post, we will explore the importance of risk management for stock market investors and discuss some essential tools that can be used to effectively manage risk.

The Importance of Risk Management

Risk management plays a vital role in the success of stock market investors. By identifying and managing potential risks, investors can protect their capital and minimize losses. A robust risk management strategy allows investors to make informed decisions, avoid emotional trading, and maintain a disciplined approach to investing.

Tools for Risk Management

1. Diversification: One of the most effective tools for managing risk in the stock market is diversification. By spreading investments across different asset classes, sectors, and geographies, investors can reduce the impact of any single investment on their overall portfolio. Diversification helps to mitigate the risk of significant losses and provides a buffer against market volatility. 2. Stop-loss orders: Stop-loss orders are another valuable tool for risk management. These orders automatically trigger a sell order when a stock reaches a predetermined price. By setting a stop-loss order, investors can limit their potential losses and protect their capital in case the market moves against them. 3. Asset allocation: Asset allocation refers to the distribution of investments across different asset classes, such as stocks, bonds, and cash. By diversifying their portfolio through asset allocation, investors can balance risk and return. This strategy helps to reduce the impact of market fluctuations and provides stability to the overall portfolio. 4. Research and analysis: Conducting thorough research and analysis is essential for effective risk management. Investors should stay informed about market trends, company fundamentals, and economic indicators. By staying informed, investors can make informed decisions and identify potential risks before they materialize.

Conclusion

Risk management is a crucial aspect of stock market investing. By implementing a sound risk management strategy and utilizing tools such as diversification, stop-loss orders, asset allocation, and research, investors can effectively manage risk and increase their chances of success in the stock market. Remember, investing in the stock market always carries some level of risk, but with the right approach, investors can minimize potential losses and maximize their returns.

+ There are no comments

Add yours