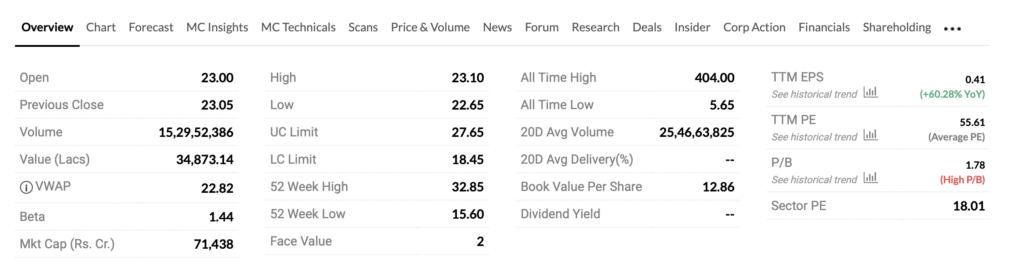

Yes Bank which is trading at 22.8 (on 28th May) has made a recent high of 32 in Feb and 28 in April is facing selling pressure from highs. Every time stock tries to rally there is some news come and it spark selling pressure.

There are two big news that have sparked selling pressure on Yes Bank :-

- Carlyle Group divested nearly a 2 per cent stake in private sector lender Yes Bank for Rs 1,441 crore through an open market transaction.

- A news report on April 29 said that SBI has received the government’s approval to divest its entire 25.02 percent stake in Yes Bank, as a lock-in period ended in March.

Now investors are First, wondering why investors are selling their stake and aren’t they confident about Banks future. On the other hand there are other investors entering and buying these bulk shares suggest these new parties are now positive. Well different people have different way of looking at information.

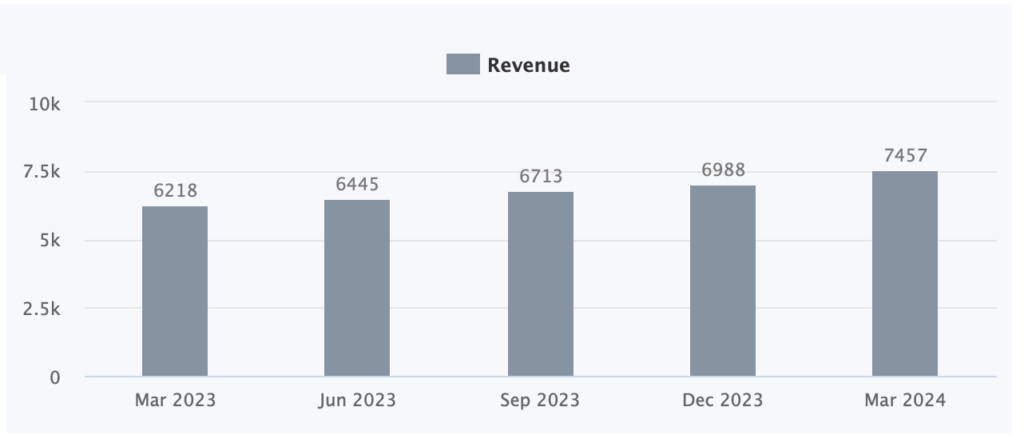

If we look at data we see that Yes Bank now has started posting positive numbers.

- Revenue soaring QoQ consistently, shows confidence at least in the operations front.

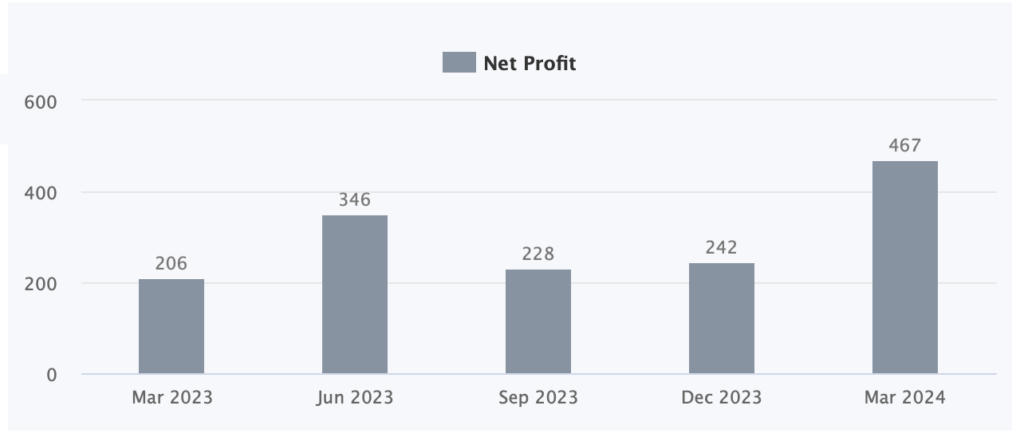

2. Net Profit is not growing that consistantly as revenue is, shows Bank either have provisions issue that keep popping up or other expense keep moving up and down. Needless to say Banks keep opening New Branches and ATMS and that add to OPEX.

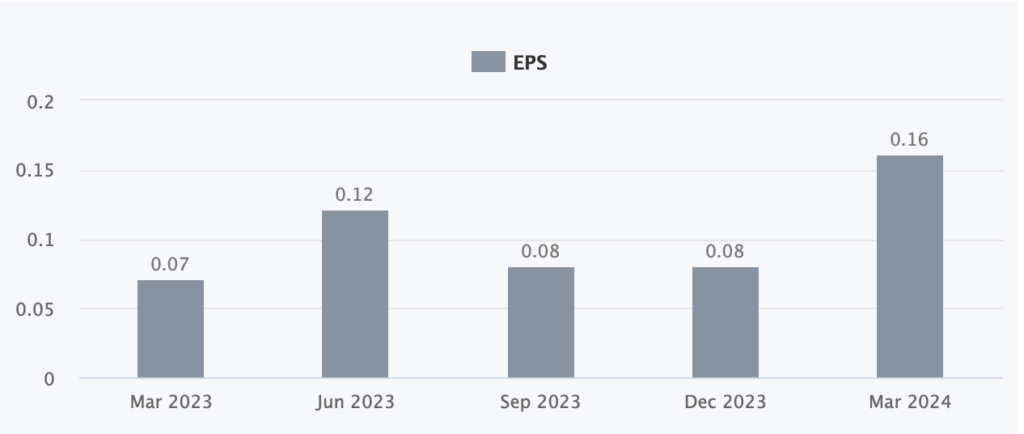

3. With Profit keep fluctuating, EPS follow the same line.

But now what, if we look at the EPS, it’s growing by 60% on YoY basis. Its PE Ratio is 55 and sector PE is just 18, so market is anyways giving higher valuation to Yes Bank against other Banks in the market, but why market is doing that, well that could be because of its low ticket price comparing to peers.

Against its earning Bank looks overvalued and retail investor who hold 36% of Yes Bank find it a value buy and hope that one day bank will again reach its old time high.

Well that quit possible but for that Bank has to improve its EPS big time and that will take years to follow but with competition growing in Banking sector where other banks are also opening newer branches everyday and NBFC and small rural banks culture growing in India Yes Bank has to think out of the box or have to show exceptional operational and innovative efficiency.

For now it looks like that investors have to fasten the seat belt in Yes Bank because stock will keep flucuating with news of all kind hitting the bank valuation and only one thing that can protect the bank is its consistant quarterly numbers. In Revenue what bank has achieved need also to be converted in bottomline consistency.

Disclaimer :- All the facts & the figure presented in the article are taken from internet and all the opinion presented in the article are authors personal opinion and this is not at all an investment suggestion. Before any buying and selling in the stock, please check with your investment advisor.

+ There are no comments

Add yours